Consumers prioritize convenience and speed when choosing a payment method.

- Convenience (34%)

- Speed (29%)

- Security (22%)

- Cost (3%)

Collect More Payments, without Added Hassle

Experience the benefits of a powerful all-in-one payment platform without the need to learn a new system or software. Implementation specialists set everything up for you, so with minimal effort, you can:

Increase collections

Boost cash flow

Enhance customer satisfaction

Reduce manual labor and data entry

Expedite workflow efficiency

Lower administrative and third-party costs

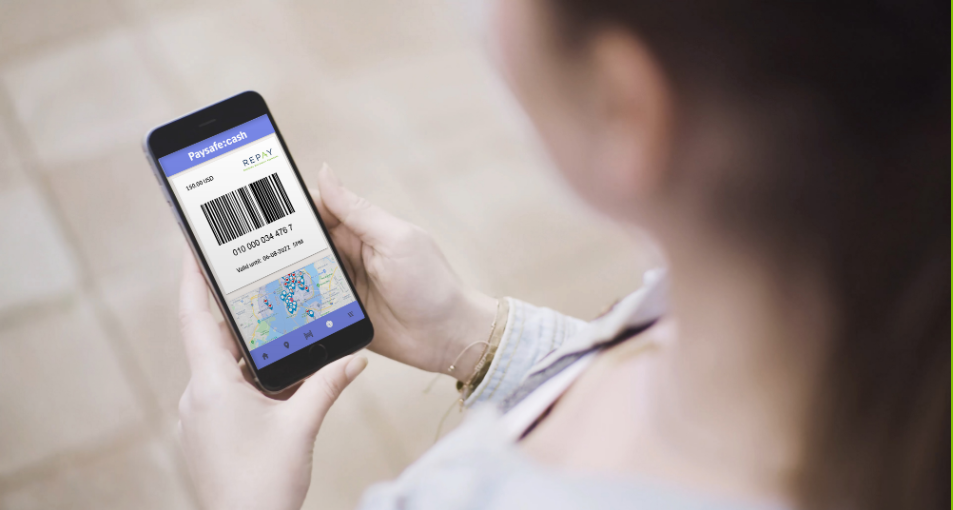

Reduce Delinquent Payments with More Convenient Options

Accept customers' preferred payment types and enable them to pay through any channel. Using the REPAY platform, customers can make frictionless payments using a debit card, ACH or cash anytime, anywhere, increasing on-time payments.

Benefits of REPAY

Traditional payment systems cost you precious time and negatively impact your bottom line. With a frictionless, centralized solution in place, you can save thousands by digitizing costly payment processes and gaining visibility and control over your funds.

Speed up the time to revenue, increase on-time payments and reduce costs by accepting debit card payments. Too many customers relying on checks can lead to untimely processing and an increase in returned transactions, plus fees associated with them.

-

Integrates with your ARM system

Integrates with your ARM system -

Convenient debit cards with digital wallet support

Convenient debit cards with digital wallet support -

Robust reporting for increased visibility and simplified reconciliation

Robust reporting for increased visibility and simplified reconciliation -

Enhanced security and PCI compliance with tokenized card data

Enhanced security and PCI compliance with tokenized card data

ARM rules and regulations are constantly changing, but that shouldn’t impact how you process payments. We have relationships with multiple proprietary sponsor banks so you can ensure a consistent payment experience when regulations change.

-

Seamless transfers between sponsor banks for peace of mind

Seamless transfers between sponsor banks for peace of mind -

Expertise in ARM and the strict regulations of the industry

Expertise in ARM and the strict regulations of the industry -

Complete compliance through SOC 1 Type II, SOC 2 Type II, PCI DSS and HIPAA

Complete compliance through SOC 1 Type II, SOC 2 Type II, PCI DSS and HIPAA

Streamline the way you collect from customers with a single payment system that integrates directly into your ARM platform. Our technology makes the transition straightforward for you and your employees, requiring little training and optimizing workflows almost immediately.

-

Detailed transaction data automatically posts back to your core system to reduce manual data entry

Detailed transaction data automatically posts back to your core system to reduce manual data entry -

24/7 live support from dedicated specialists

24/7 live support from dedicated specialists -

Realtime payment tracking increases visibility and improves exception management

Realtime payment tracking increases visibility and improves exception management

Benefit from Faster, More Secure Payments

Digital payment technology evolves every day, and REPAY has the resources and expertise to keep you ahead of the changes. Rely on REPAY to simplify payments and manage the platform integrations for improved cash flow, streamlined internal processes and increased customer satisfaction.

Learn More on the Blog

8 Things Your Payment Provider Must Have in the ARM Industry

One characteristic of collection agencies that complicate payment acceptance is the nature of their business. Not only are these agencies in a highly regulated industry, but they are also unfairly classified as a high-risk industry and lumped in with gambling, nutraceuticals, and cryptocurrency companies to name a few.

Payment Options to Delight Customers

Customer demands and preferences are constantly changing. They value convenience and speed during the payment experience in today's fast-paced environment. As a business owner, it's essential to provide payment options that satisfy their wants and needs. Offering multiple payment options can expand your customer base while enhancing the customer experience.

8 Reasons to Have Online Healthcare Debt Collection for Your Practice

Healthcare debt collection has been one of the most significant pain points to overcome for any healthcare practice. Without a successful collections system, paying for essentials to keep the practice running is impossible. There are several reasons why so many practices today are struggling to stay afloat and keep cash flowing.